Palace Gardens provides prime mass market retailing at the heart of this busy London suburb. Anchored by M&S and Waitrose, other tenants include WH Smith, H&M Kids, Blue Inc and Hotter Shoes.

Advertise

Size

Rent

Town

Availability

Type

Palace Gardens provides prime mass market retailing at the heart of this busy London suburb. Anchored by M&S and Waitrose, other tenants include WH Smith, H&M Kids, Blue Inc and Hotter Shoes.

We have available shops in 24 more locations near Enfield.

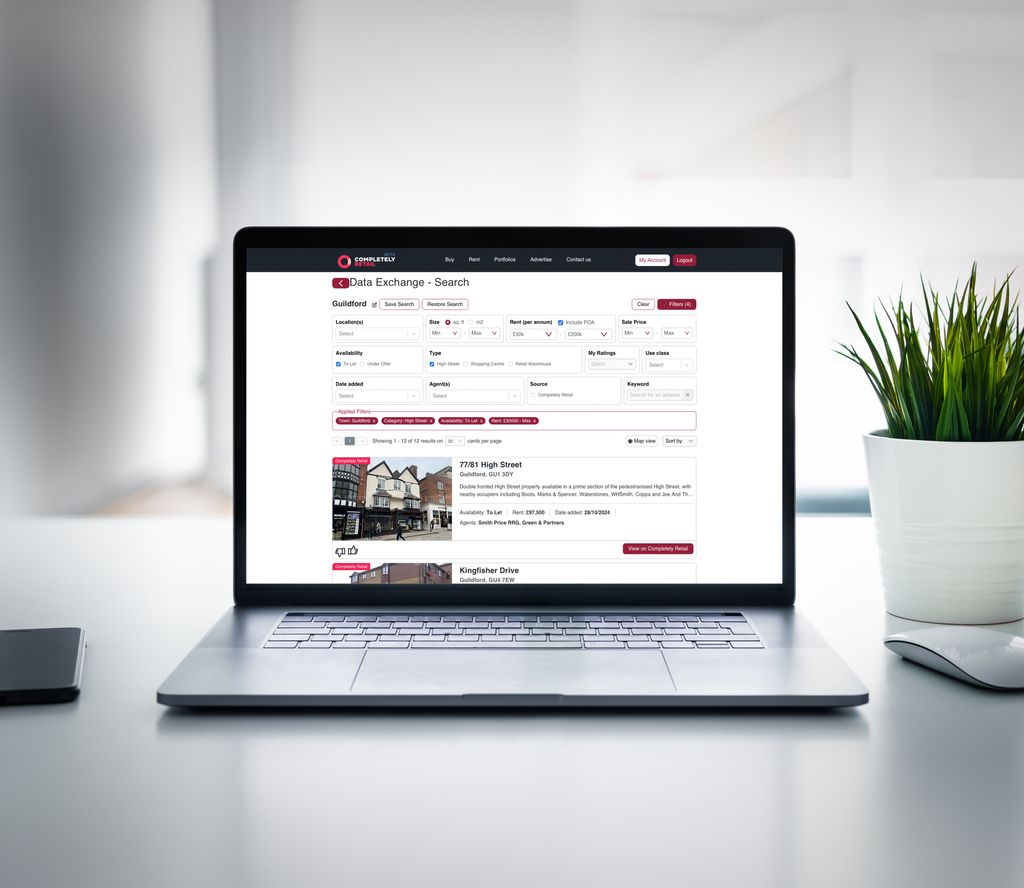

Our new Data eXchange search tool has identified another 12 available properties within your search area.

DX Search is included free-of-charge to Completely Retail subscribers or available to everyone with a simple monthly subscription.

Properties ranging from:

Rent: £30,000 - £190,000

Size: 675 sq ft - 150,702 sq ft

Shops to rent within 5 miles

Shops to rent within 10 miles

Shops to rent within 20 miles

Shops to rent within 30 miles

Thu Mar 05 2026

M&G has reached an agreement with Warner Bros. Global Experiences that will see the opening of the UK's first flagship Harry Potter store on London's Oxford Street. The two-storey store will be located at The Ribbon, M&G's £250m redevelopment, and feature licensed merchandise from the film series alongside interactive experiences. Occupying a site once home to Victorian drapers, The Ribbon takes its name from Oxford Street’s fashion-led heritage.

Tue Mar 03 2026

Competitive socialising concept Rocket Room is set to open at Market Place Food Hall Leicester Square this April. Located on the second floor of the building, the 3,500 sq ft venue will offer axe throwing, darts, shuffleboard, and beer pong in a compact setting overlooking London's Leicester Square. Rocket Room will also look to cater to larger gatherings, including birthdays, team building events, client entertainment, and full venue takeovers, with capacity for up to 120 guests.

Fri Feb 27 2026

Plans to pedestrianise London's Oxford Street have been given final approval by the Mayor of London Sir Sadiq Khan. Transport for London (TfL) have now been instructed to implement the proposed changes, which will see the removal of traffic from Oxford Street between Great Portland Street and Orchard Street, City Hall said. It is hoped vehicles will be stop using the road by September, following which further work to make the street more welcoming to pedestrians will commence.